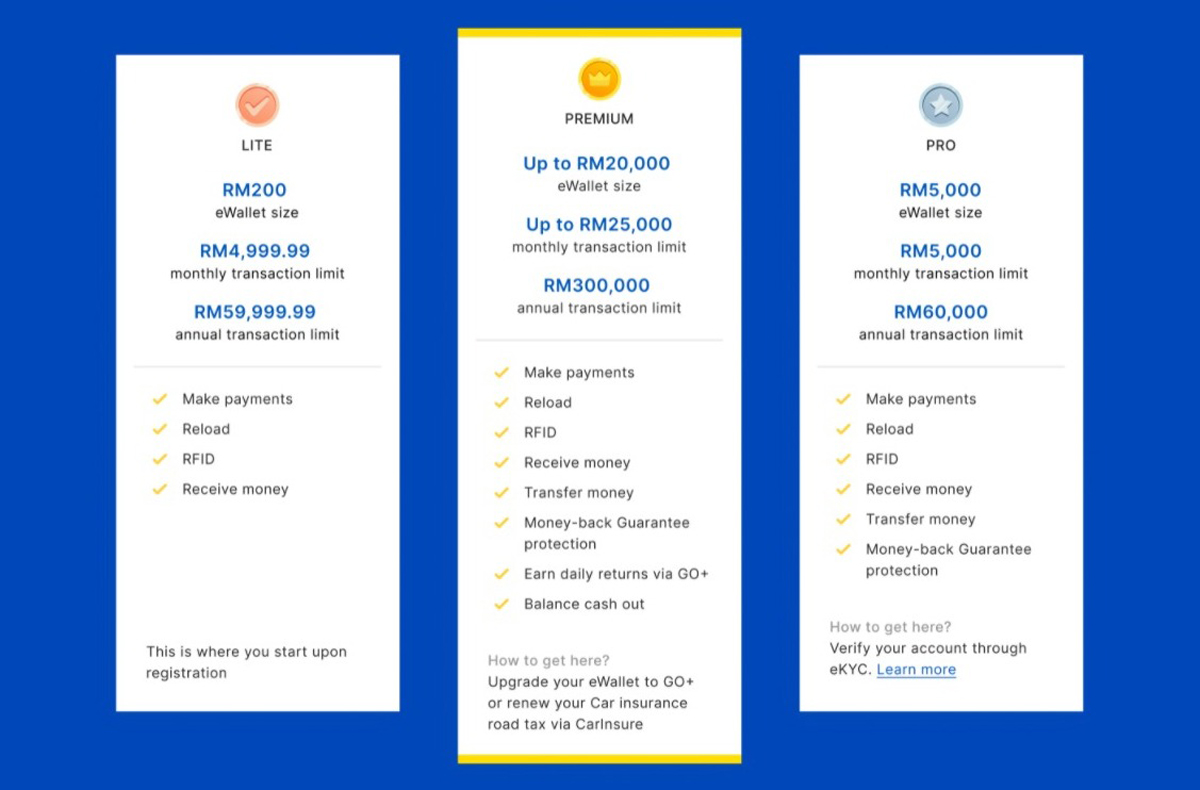

To recap, the Lite tier is applicable for unverified TnG eWallet accounts and grants users a maximum eWallet cap of RM200, monthly transaction limit of RM4,999, and an annual transaction limit of RM59,999.99. The Pro tier, on the other hand, is applicable for verified Electronic Know-Your-Customer (eKYC) accounts, which enables for a maximum eWallet balance and monthly transaction limit of RM5,000 and an annual transaction limit of RM60,000. Meanwhile, the new Premium tier will require TnG eWallet users to upgrade their account by either making an investment in GO+ feature or by purchasing a CarInsure product via the app. Once upgraded, users can enjoy an increased eWallet size of up to RM20,000, a monthly transaction limit of up to RM25,000, and an annual transaction limit of RM300,000.

Benefits that are exclusive to the Premium tier include the ability to earn daily returns via GO+, and cash out eWallet balance (again via GO+, with a limit of RM9,500 per transaction). Other than that, other services provided are similar to those that are offered with Pro tier which includes all payment transactions, money-back guarantee protection, RFID, as well as transferring and receiving money. It is also worth mentioning that the Premium tier’s eWallet balance size is one of the largest available in Malaysia. Its closest equivalent being the Lazada Wallet which also offers a limit of RM25,000, although this benefit is only applicable to those who’ve activated it via Taobao. Not too far behind is AirAsia’s BigPay eWallet that can hold a maximum of RM10,000. (Source: Touch ‘n Go press release / Official website [1] [2])